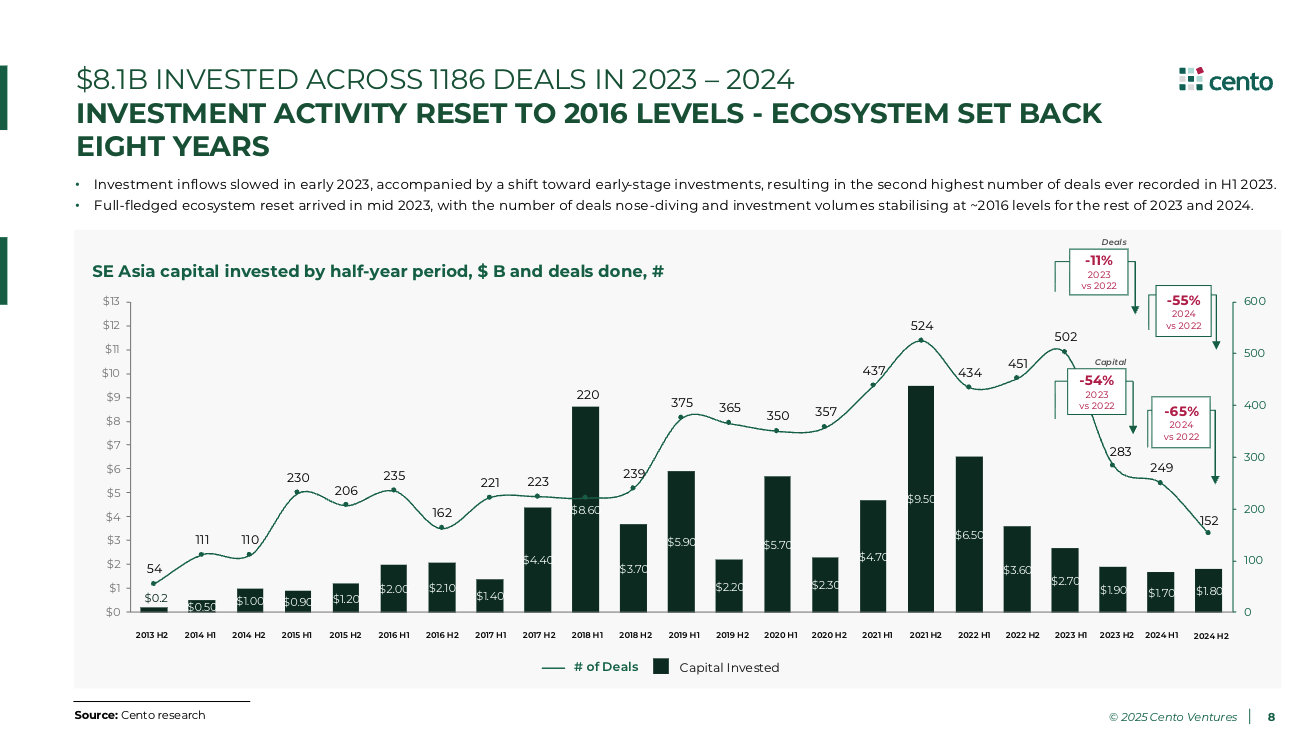

By mid-2023, it was clear that Southeast Asia hadn’t simply cooled to pre-COVID levels—it had reset all the way back to the pre-“unicorn era.” Investment volumes fell first, but valuations and deal sizes held somewhat steady into late 2024.

The region was the first emerging market to dip below its 2017–2020 baseline in H2 2022, and it’s still stuck there more than 2.5 years later. What looked like an early adjustment turned into the deepest and longest slump of any emerging market. The message is stark: 2017–2020 was a one-off funding frenzy, not a new normal.

Meanwhile, India and Latin America have left Southeast Asia in the dust. By H2 2024, both were raising more than double their historic averages, with India pulling in four times and LatAm twice as much capital as Southeast Asia.

Signs of life are reappearing—mainly in digital financial services (DFS)—but the rebound is badly lagging peers. Even in the best case, Southeast Asia will be at least a year behind the recovery curves of India and LatAm.

Deal Activity Across Stages

The capital cycle played out unevenly across stages:

- Series C+ slowed sharply as early as H2 2022, as the supply of mega-deal capital contracted.

- Seed and Pre-A surged initially, buoyed by later-stage funds moving downstream, but slowed dramatically by H1 2024.

- Series A and B held up the longest, only showing steep decline toward H2 2024.

Surprisingly, median valuations and deal sizes held up across stages into H2 2024. This was less a reflection of market strength than of a distortion: the rising use of private debt and convertible notes (not visible in standard datasets) kept the number of priced equity rounds unusually low, even as startup closures spiked and founders scrambled for profitability.

This mismatch explains why headlines point to “over-correction,” while valuations on record still appear sticky. The market is not clearing—founders have not reset valuation expectations, while investors are reluctant to meet them. Debt instruments are cushioning the gap, but obscuring the true pace of correction.

Mega-deals never disappeared; they concentrated in “flight to quality” bets, often anchored by local conglomerates or major digital groups (e.g., LineMan GXS, ANext, Bolttech, Mynt, Ascend). At the same time, internal capital injections from Sea Ltd, ByteDance, and Alibaba sustained operations. North Asian financial institutions such as Mizuho and MUFG also continued to provide late-stage capital, underscoring that even amid correction, Southeast Asia remains on the radar for strategic investors.

Growth Narratives: Tested and Revised

Since Indonesia’s valuations peaked in early 2022, investors have cycled through competing narratives in search of the next regional growth story:

- Vietnam as the “Next China” lost momentum as political shifts in 2023–2024 dampened confidence.

- The Philippines as the “Next Indonesia” came under scrutiny as closer analysis of Indonesian middle-class economics cast doubt on the sustainability of consumer-led theses, especially after failed IPOs of consumer companies.

Both narratives leaned heavily on consumer spend, which proved less robust than expected.

What has emerged instead is the dominant story of digital financial services, particularly in the Philippines. The country’s unique combination of light-touch regulation and financial disparities has propelled its financial sector forward. Meanwhile, Indonesia continues to provide scale for digital lenders experimenting both with and without bank charters.

Digital Financial Services: The Bright Spot

Digital financial services now account for three-quarters of all capital deployed in Southeast Asia (up from 35–40% historically), making it the only sector with growing investment volumes as of H2 2024.

The sector’s resilience is underpinned by:

- Rapid modernisation of payment infrastructure and regulatory frameworks.

- A cohort of payments players that have reached sufficient maturity and scale to fundraise even in downturns.

- Early evidence that digital lenders can operate profitably at scale, especially in the Philippines and Indonesia.

The shift is strategic: most digital platforms have abandoned the “super-app” thesis in favour of originating and distributing financial services. Digital finance has become the key driver of profitability announcements across leading platforms in 2024.