Following up on our overview of Southeast Asia tech investment in H1 2021, we teamed up with Momentum Works to take a look at how the Southeast Asian digital ecosystem compares to other emerging regions globally, starting with Latin America courtesy of excellent research made available by LAVCA.

The traditional economy is going through a process of digitalisation in both regions. Some sectors are doing it in pretty much the same way, while the pathway of other sectors differs rather radically. We are putting together a framework that attempts to explain the nuances of digital ecosystem formation by looking into:

- Capital availability across time and stages

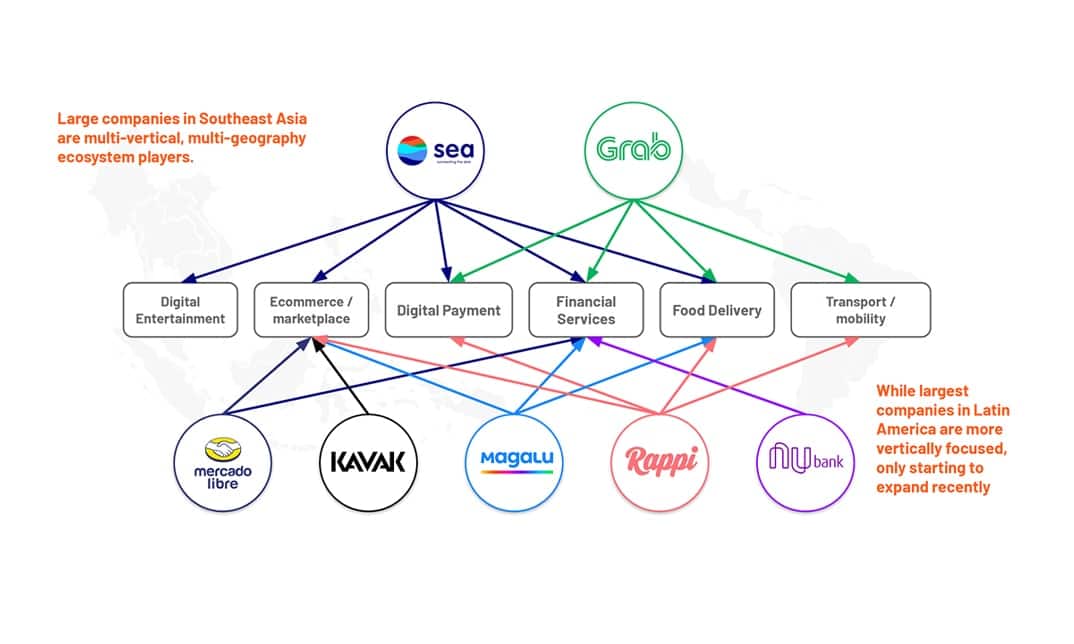

- Key company building templates followed by founders and investors

- Digital demand depth and concentration

- Incumbent player responsiveness

Latin American tech investment overtakes Southeast Asia after years of trailing behind

We take a look at how access to capital has evolved across the two markets and find Latin American tech investment surging in H1 2021, in an echo of what was seen in Southeast Asia in H1 2018. The concentration of Latin American tech investment in Brazil and Mexico mirrors the relative positions of Indonesia and Singapore in Southeast Asia.

Parallel development and ongoing convergence

The two regions play very different roles in global value chains and have had rather different macroeconomic dynamics of late. However, the parallels that exist between key parameters of each digital ecosystem are striking, from the rising power of consumers to the behaviour of the regulators. After 20 years of nearly independent evolution, the two digital economies do not mirror each other, but their development often seems to rhyme. In some sectors, like payments and classifieds, the structure of digital industries in countries like Argentina and Malaysia, or Mexico and Thailand are starting to look very similar indeed.