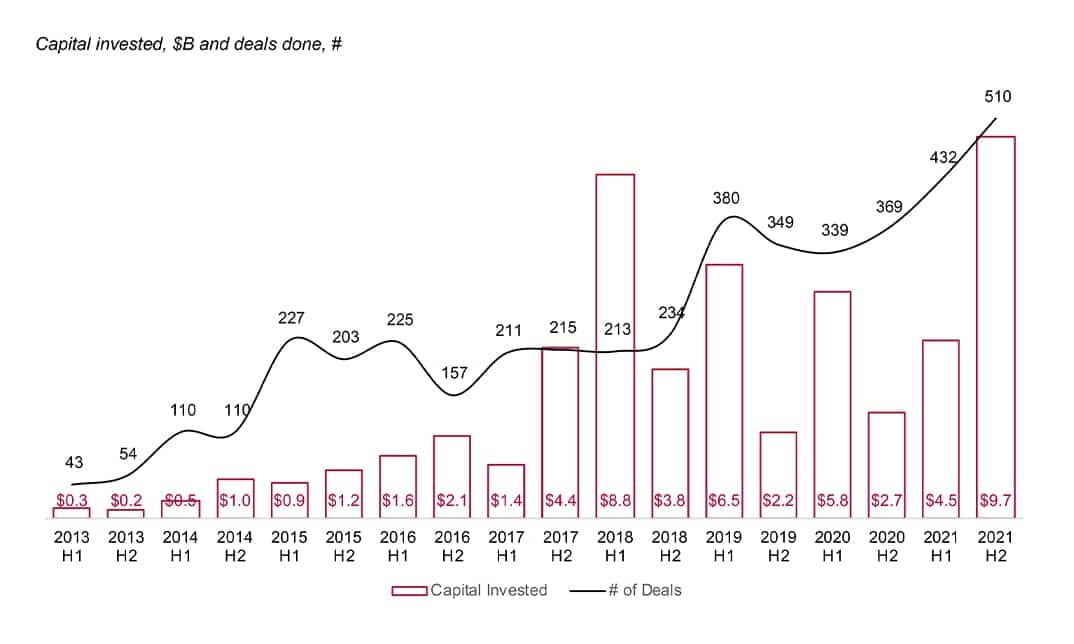

2021 saw a record number of deals and the total amount invested. We tracked 942 investments across the region, exceeding the 700 recorded in 2020. Total capital invested, at $14.2B, increased by nearly 70% compared to 2020. A large contributor to this increase was the return of mega-deals. The largest deals (those over $100M) accounted for 52% of the investment.

Smaller deals (those below $100M) also continued to break records for Southeast Asia investment. Deals sized between $10M to $100M almost doubled compared to 2020.

Deal sizes and valuations rise sharply

2021 saw a sharp upturn in both deal size and valuation. Median round sizes rose, with Pre-A rounds of $1M, Series A rounds of $5M, and Series B of $15M.

While we don’t have full information on valuations, the evidence we have indicates that valuations at each stage doubled in 2021. Median valuations for Pre-A deals are at $6.3M, Series A at $21M, and Series B at $62M.

Indonesia and Singapore still attract the most capital

2021 was again quite typical in terms of the geographic distribution of deals. 42% of the capital was invested in Indonesian startups, and Indonesian and Singapore startups combined accounted for 64% of the total number of deals done. There was also an increase in activity in the Philippines and Vietnam.

Financial services have become the largest sector for investment

Fintech startups saw a huge increase in investment, in that case about three times the volume of 2020. Financial services appear to be the sector of investor focus at the moment.

Beyond fintech, there was a growth in investment across many other sectors, as investors continued to back retail and logistics startups. There was also an increase in activity in other sectors, including business automation, real estate, education, and healthcare.

New unicorns

2021 saw PropertyGuru, Nium, Carro, Carsome, Carousell, Xendit, Advance, Akulaku, and Codapay added to Southeast Asia’s companies valued at over $1B. Many startups raised new rounds that valued them at over $100M (please see the report for details).

IPOs appear

IPOs accounted for more than 50% of our liquidity tracking in 2021. This was the product of a few large IPOs carried out by CTOS, Bukalapak, and Society Pass, and may signal the start of an interesting trend, regardless of the current volatility in public markets.

Other types of exit in 2021 increased in the second half of the year, although it was still lower than in 2020. We continue to assume that some larger potential deals have been delayed and that we will see some further growth in trade sales in 2022.