Following up on our review of the Southeast Asia tech investment landscape in mid-2022, we’ve taken a look at how the whole year has turned out, based on our database of over 6,000 financing and liquidity events relevant to the region.

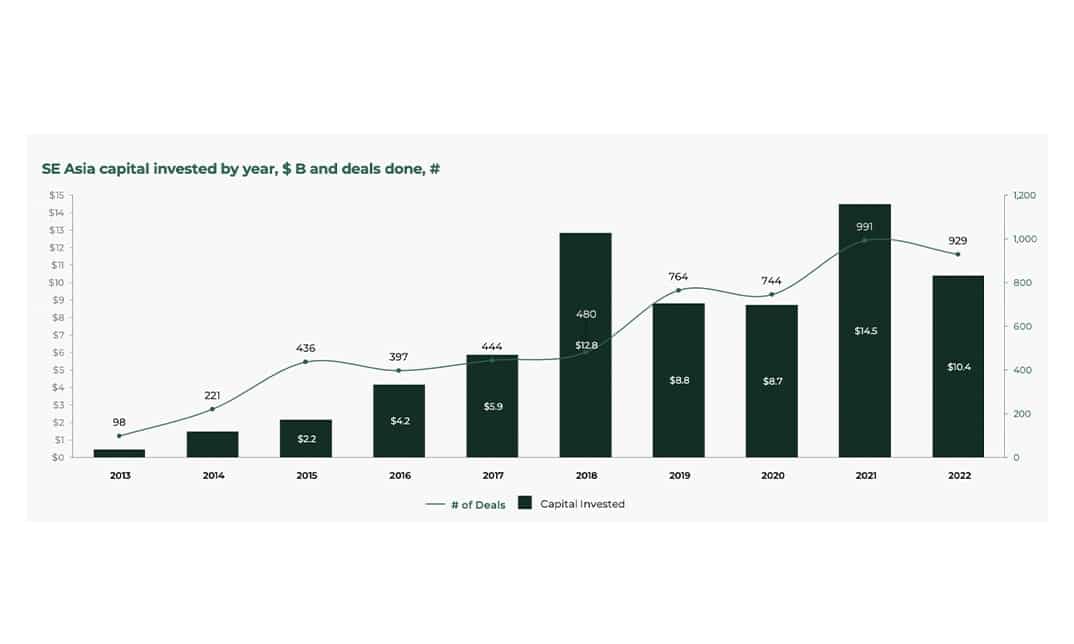

After a solid start following the highs of 2021, 2022 shaped up to be Southeast Asia’s third strongest year on record in terms of capital raised (US$ 10.4B across 929 deals). Even as the capital markets globally soured, the region did not see an abnormal slowdown, with H2’22 at about 50% of H1’22 investment volume, a pattern seen in 2018, 2019, and 2020. However, below the headline numbers, we see the ecosystem in turmoil, with significant valuation swings, shifting regional priorities, and changing composition of active investors all through the year.

As global tech faces a sharp downturn in early 2023, we note that Southeast Asia in 2022 is not too far off its 2017-2020 capital intake baseline (US$ 9.1B per year on average) and stands a chance of milder correction as compared to the peer regions (India’s 2022 stood at 3.2X of 2017-2020 baseline, Latin America came in at 2.5X). The region continued to distribute significant amounts of liquidity to its early investors, with a record US$ 4.6B in proceeds generated across trade exits, IPOs, and secondaries.

Similar investment volumes, changing investment priorities

The region underwent a rapid change of active investor composition halfway through the year, causing a reallocation of capital between geographies and stages and significantly changing the valuation landscape. Global late-stage investors powering Series C+ and mega deals categories were in retreat, redirecting their effort towards investment stages as early as Series B and then nearly leaving the market altogether. Regional and North Asian investors remained present across late-stage deals, bringing mega-deal activity down to 2016 levels and Series C+ to late 2019 levels.

Funds managed by SEA investors have accumulated enough dry powder to keep Series A-C going at a usual volume (capital invested in the H2 2022 decreased by 48% vs H1 2022, a drop off typical for 4 out of 5 preceding years), with a slowdown visible only in the very last weeks of 2022.

The valuation landscape changed sharply through the year, with Series B valuations most volatile – Indonesia’s Series B valuations surged during global players’ retreat into earlier stages only to come back down to late 2021 levels towards the end of the year; Series B valuations in Vietnam have come down steadily through the year from the exceptional heights of 2021.

Returns on invested capital arrive with a vengeance

Private market liquidity (trade exits and secondaries) and initial proceeds from IPOs, despite the subsequent weak performance of listed stock, delivered the best year for exits on record, with 4 liquidity events generating more than $500M in proceeds each – GOTO and BELI IDX IPOs; 2C2P and Coda Payments transactions. Additionally, 10 liquidity events delivered north of $100M in proceeds each.

The top quartile median exit valuation has continued its steady rise from under US$ 100M in 2018 to nearly US$ 0.5B in H1 2022, setting a new benchmark for the value of a well-built regional digital platform.

Digital financial infrastructure upgrade

Digital financial services remained the key investment theme for the region, representing 46% of overall 2022 liquidity, 43% of all 2022 equity funding, and responsible, additionally, for billions in private credit facilities lined up to support an array of non-bank lenders across the region (which our report doesn’t yet track but someone should! We’re looking at you, ASEAN Central Banks).

As private credit grew more sophisticated and available, investment into digital financial services shifted from powering lending facilities and user acquisition to upgrading the key financial infrastructure of the region, with payments value chain and capital market systems being primary beneficiaries.

The sector’s vitality reflects rapid updates to regional payment infrastructure and regulations, a variety of bank charters available to tech companies, and the shift of focus by existing digital platforms as they leave the “super-app” thesis behind in favour of financial services origination and distribution.