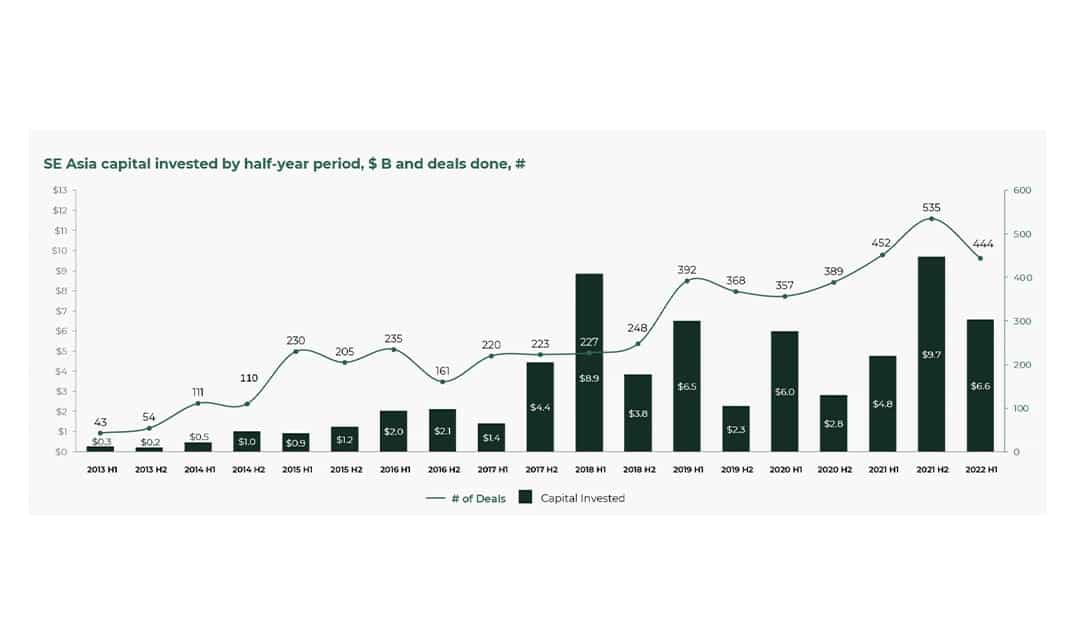

The first half of 2022 was a vigorous opening to a tumultuous year in Southeast Asia. For this report, we analysed and verified over 5,500 financing and liquidity events relevant to the region. Total capital invested in 2022 H1 stood at $6.6B across 444 deals, both of which are second highest numbers for half a year on record. Series B companies saw a 50% upward jolt in their valuation thanks to a surge in interest from both earlier-stage investors with newly raised growth funds and later-stage investors moving upstream, while valuations for Series A rounds slowed their growth considerably and pre-A valuations remained nearly flat. The record amount of US$ 5B of liquidity had been distributed to investors over the 12 months ending in 2022 H1, another record for the book.

Strong start to a tumultuous year

2022 started strong with US$ 6.6B going into the regional ecosystem, second only to H1 2018, thanks to Southeast Asia’s core venture funding “stack” now able to supply the region with nearly US$ 5B every half a year. Yet the number of deals done slipped 23% from H2 2021 to early 2021 levels as more companies opted to cut costs or borrow rather than issue new equity in the face of rapidly deteriorating capital markets.

As public markets nose-dived across the world and IPO window(s) closed, pre-IPO mega-deals slowed down across growth markets. Southeast Asia was no exception with just 9 US$ 100M+ investment events in H1 2022. Surging instead was the late growth stage, with deal activity in the US$ 50-100M range growing 3X+ year on year, as later-stage investors retreated from mega deals and shored up the finances of their portfolio companies.

Surging Series B valuations

Southeast Asian early-stage VCs, who had dramatically expanded their assets under management during the 2019-2022 fundraising run, are now shifting their focus towards later-stage US$ 10M+ deals and Series B opportunities. The same opportunities are also attracting global late-stage investors in H1 2022 looking to move upstream and even further away from quickly souring US$ 100M+ investments. As a result, Series B valuations surged 50% in Southeast Asia.

Battle of narratives and search for the next growth story

Indonesia’s market continued to see sector saturation and elevated valuations. As the median Series B pre-money valuation of Indonesian startups in H1 2022 exceeded the regional median exit valuation by a factor of 2.1X, the search for a new regional growth story is underway. H1 2022 saw the Philippines’ steady rise overtaking Vietnam’s volatile market yet again, as the narratives of Vietnam’s “Next China” and the Philippines’ “Next Indonesia” are being tested against each other.

Imbalances and contradictions abound

As the region entered the transition from years of capital abundance into the 2022 slowdown, its many imbalances and contradictions were thrown into sharp relief. Venture capital distribution across the region remained broadly disconnected from the economic power of underlying economies, with Malaysia and Thailand (with combined nominal GDP nearly equal to that of Indonesia) receiving 20% of Indonesia’s venture funding.

Valuations across the region continued to vary wildly, with a 6-8X gap between median pre-money valuations in the most and least funded markets across Series A and Series B. Indonesia and Singapore were the only two markets where the median Series B pre-money valuations reached or exceeded regional median exit valuations.

Exit proceeds hit a high note

Between the IPOs in H2 2021 and robust trade sales and secondaries in H1 2022, Southeast Asia had just seen US$ 5B of liquidity distributed to investors over the 12 months, the best-performing 12-month period on record. Encouragingly, the top quartile median exit valuation continued its steady rise from under US$ 100M in 2018 to nearly US$ 0.5B in H1 2022, setting a new valuation benchmark for well-built Southeast Asian digital platforms.

Digital financial services remain key to the Southeast Asia market

Responsible for 75% of overall liquidity in H1 2022, digital financial services had also absorbed nearly 50% of all investment into the region in the same period, up from just 8% in early 2019. The sector’s vitality reflects rapid upgrades to regional payment infrastructure and regulations, the increasing availability of various bank charters to tech companies, and the shift of focus by existing digital platforms as they leave the “super-app” thesis behind in favour of financial services origination and distribution.