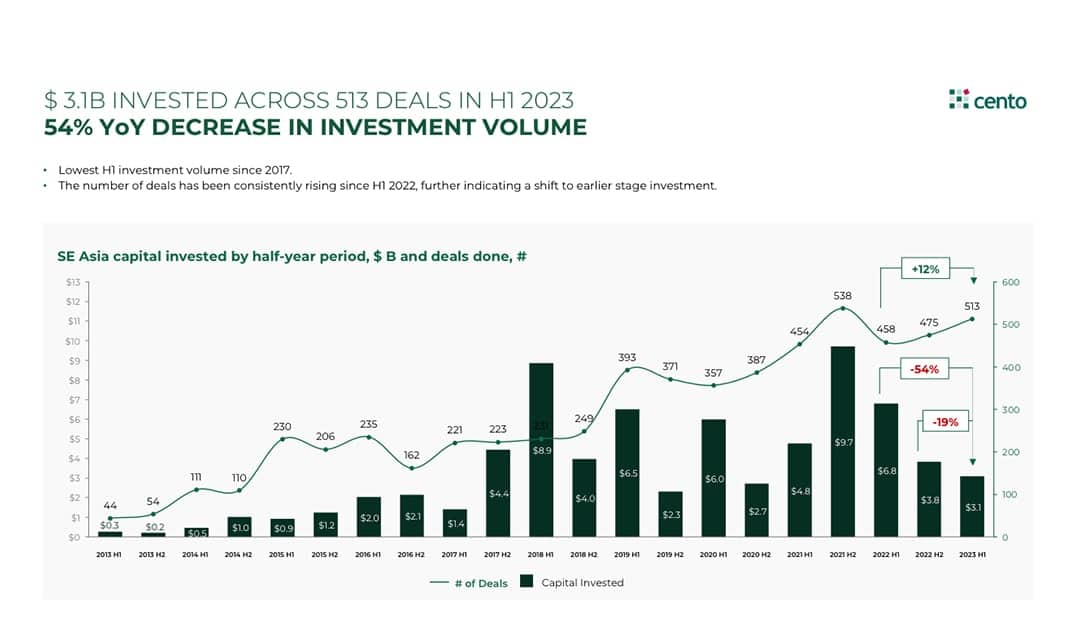

For the first half of 2023, Southeast Asia saw a 54% year-on-year drop in investment volume to $3.1B, the lowest H1 investment since 2017.

The deal landscape appears to be reversing to levels seen before COVID — and quite possibly to pre-unicorn era standards. The return to pre-dual-bubble valuations and deal sizes is following the decrease in investment volumes but with a significant lag. Interestingly, this market correction only took place a full year after the first chills of the market downturn were felt in the US — the region did not see a sharp decline in capital intake until the end of 2022.

With half of the capital gone, Southeast Asia remains firmly below its 2017-2020 capital intake baseline — the only global market other than China to have adjusted so quickly, as 2021-2022 exuberance hasn’t lifted investment levels in Southeast Asia nearly as much as in India or Latin America. This, along with the mega-deal volume at a historic minimum, leads us to believe Southeast Asia might be looking at a slightly softer year-on-year drop in investment activity going forward compared to its peer regions.

SEA investors maintain the pace, and valuations beginning to adjust

As the region entered an era of correction, investors continued to shift their attention towards earlier stages. Despite the growing negative mood towards the second half of 2023, Southeast Asia’s core venture stack held up surprisingly well. We saw capital across pre-A to Series C (all $0.5-50M per deal ranges) was still being deployed at about the same pace as in the preceding three years. The mega-deals category ($100m+) however is nearly at a historic minimum with only a few companies in the region (eFishery, bolttech, Kredivo and Moladin) raising or announcing $100M+ rounds in H1 2023.

Valuations have continued to adjust, albeit rather gradually. Series B valuations experienced the most turbulence, with Indonesia and the Philippines leading the way. Series B investors in these two markets have been most attuned to the availability of later-stage rounds (US$ 50-100M per deal) that dried up already in H1 2023. Across Series A and B, valuations have started converging across the region, with Southeast Asia’s notorious valuation gap between markets shrinking significantly.

The decline in regional investment activity is likely coming to a close. However, changes to the valuation landscape are only just beginning. Developments such as runways accumulated in 2021-2022 getting shorter and the initial slew of company closures becoming public are significantly impacting investors’ mindsets. The true picture of company valuations in the region will remain obfuscated by the dual “crutches” — structured internal rounds and private debt, which are being liberally applied to delay the re-pricing of digital companies across the ecosystem.

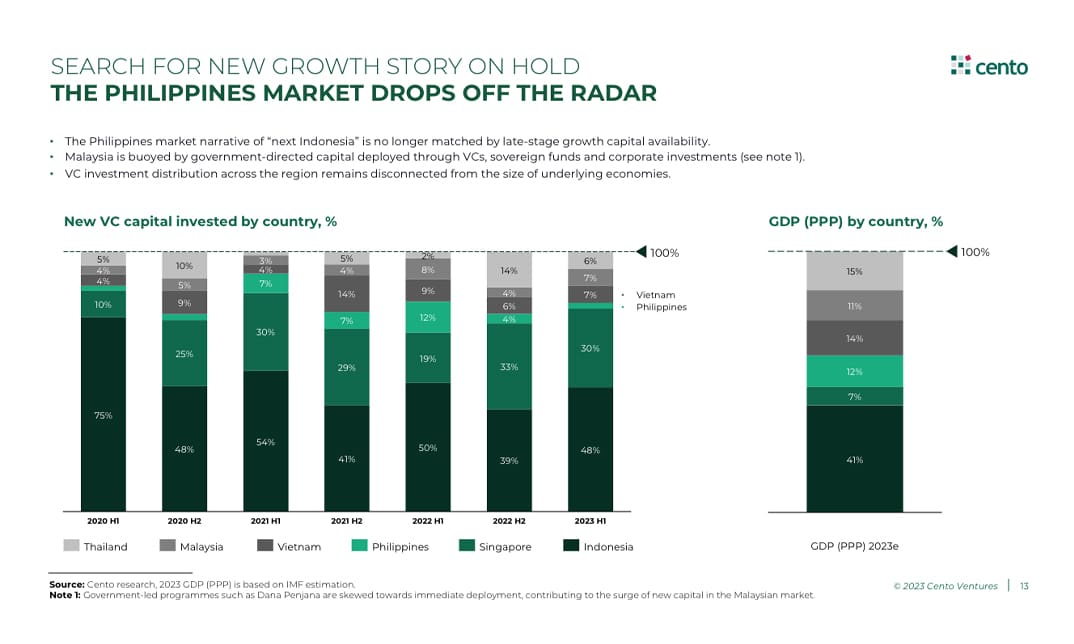

Search for the ”Next Indonesia” is on pause

Since early 2022, as valuations in Indonesia peaked and the search for the next regional growth story unfolded, narratives of Vietnam’s “Next China” and the Philippines’ “Next Indonesia” have been tested against each other. Nearly two years on, neither market is a clear break-out story.

Vietnam has seen multiple launches of early-stage investment funds and held on to a respectable portion of regional investment flow, despite investment activity having been subdued on account of the economic malaise. The Philippines market has seen a surge of activity from multiple local conglomerates and the emergence of multiple capital-intensive business models, mirroring Indonesia’s trajectory in 2017-2019. These developments, however, are meeting with the near absence of later-stage capital to power them further.

Elsewhere, the Malaysian government’s attempt to super-charge investment activity in the country through multiple government agency-led programs may have worked, giving the country a share of regional investment equal to Vietnam and a significant uplift in Series A and B valuations.

The liquidity window is shut

The IPO window has closed with a vengeance, a few small listings in NASDAQ and belated SPACs notwithstanding. Corporate acquirers remain interested in the region but expect the acquisition pricing to be minimal, while founders’ and VCs’ expectations haven’t yet adjusted. As a result, the M&A market did not clear at all in H1 2023, with the lowest exit activity in a decade — such levels were last seen in 2013, in stark contrast to the record-high liquidity volume in 2022.

Digital financial services power ahead, with slight changes to sub-sector dynamics

Digital financial services are back to the north of 40% of all investments, with all sectors powering ahead and rendering the “death of fintech due to high-interest rates” narrative somewhat obsolete. The sector’s vitality remains underpinned by the rapid updates to regional payment infrastructure and regulations, a variety of bank charters available to tech companies, and the shift of focus by existing digital platforms as they leave the “super-app” thesis behind in favour of financial services origination and distribution.

The collapse of crypto-currency trading volumes and adjacent investment narratives have significantly impacted the amount of DFS investment flowing into wealth management and capital market infrastructure sub-sectors during H2 2022. Consequently, these sub-sectors went back in line with their historic capital intake volumes.